Momentum is the tendency of recent price changes in an investment or asset class to persist for some time into the future. The evidence for momentum is pervasive, supported by academic and practitioner research and more than 300 published papers over the past decades. I won't attempt to summarize the momentum literature, but encourage investors to learn more about it, starting with the bibliography, below.

Momentum can be used to create a disciplined, systematic investing style that applies across asset classes. Momentum based strategies have been successfully used by investors for over a century.

What causes momentum?

Investor behavior is one important cause of momentum: market participants, driven by basic human emotions such as fear and greed, tend to either overreact or underreact during different time frames. Investors tend to buy securities that have risen in price, and sell those that have already fallen. This behavior sustains price trends in an asset class or security. Investors also exhibit herding behavior, a type of misreaction which in extreme cases can lead to speculative frenzy (an economic bubble), followed eventually by a significant deflation in prices (or popping of the bubble). Examples include the technology stocks bubble in 2000, or more recently the U.S. real estate market.

The Momentum Premium

Many investors are familiar with the value premium: the fact that value stocks, in the long run, outperform growth stocks. As a result, investment advisors often recommend shifting the stock allocation of a portfolio a little towards value stocks, a so-called “value tilt.”

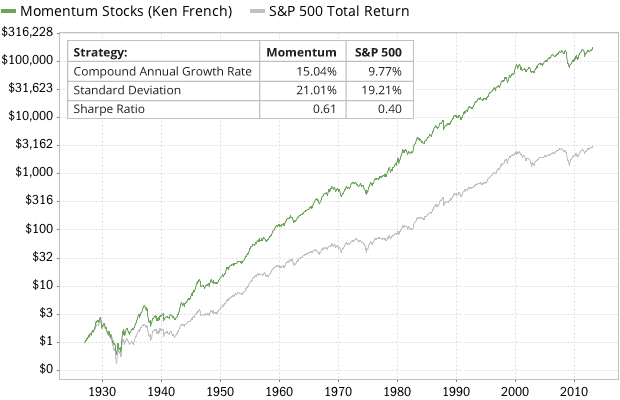

The momentum premium is even more significant and pervasive. Finance Professor Kenneth French at Dartmouth university and his colleagues have exhaustively studied the behavior of security prices and investment strategies. Below is a chart with data from Dr. French’s research, showing the outperformance of U.S. momentum stocks for the past 85+ years. As you can see, the momentum portfolio outperforms the S&P 500 index by over 5% per year:

(As a comparison, professor French’s value stock portfolios outperform the S&P 500 by “only” 2-3% per year). Studies like these (and similar research conducted over the past decades) have clearly established momentum as the most significant investment return factor in global financial markets. It’s a bit of a mystery why momentum investing is not at least as widely accepted as value investing. More on that in a separate post.

Momentum applies across asset classes

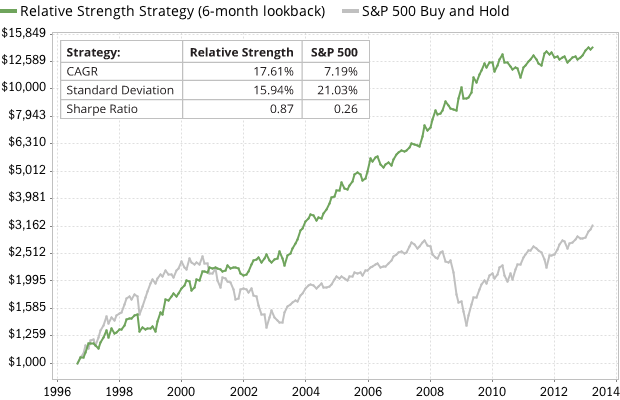

But why limit ourselves to just U.S. stocks when momentum applies across asset classes? Even a trivial application of momentum can generate significant excess returns in a globally diversified portfolio. Let’s examine a simple momentum strategy applied to the same 9 ETFs that we use in our adaptive portfolios.

The rules of this “system” are simple: we measure the 6-month price change in every asset class, and construct a portfolio that invests in the top 2 performers (the two ETFs with the greatest percentage gain over the past 6 months). We repeat this every month, “changing horses” whenever the data selects new winners.

The results speak for themselves: the ETF portfolio outperforms S&P 500 buy and hold by over 10% per year, and turned a $1,000 investment in 1996 into $14,852. By comparison, a $1,000 investment in the S&P 500 would now be worth $3,174. Impressive returns for such a simple strategy. There’s nothing new about this particular approach: Mebane Faber and others have documented similar Relative Strength strategies and results. What we’re not showing here is that the drawdowns (peak-to-trough portfolio declines) of simple momentum strategies can be severe, and you need a more sophisticated approach to improve risk-adjusted returns. But this simple example illustrates that momentum works quite well across asset classes, and can be a powerful “building block” in the construction of robust investment portfolios.

Selected Bibliography on Momentum

- Narasimhan Jegadeesh and Sheridan Titman, Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency, March 1993

- ABN-AMRO, Global Investment Returns Yearbook 2008, February 2008

- Clifford S. Asness, Tobias J. Moskowitz, and Lasse Heje Pedersen, Value and Momentum Everywhere, June 2012

- AQR Capital Management, The Case for Momentum Investing, 2009

- Tobias J. Moskowitz, Momentum Investing: Finally Accessible for Individual Investors, 2010

- Michael W. Covel, Trend Following, 2009

- Stig Ostgaard, On the Nature and Origins of Trend Following, December 2008

Comments

To add a comment, please Sign In.