The Vanguard Group has staked its reputation on low-cost passive investing. It created the first index fund, and has a solid lineup of 64 stock and bond ETFs, all of which can be traded commission-free by Vanguard brokerage account holders. While the company has announced plans to expand into alternative asset classes (alternative beta), it does not offer commission-free trades in gold or commodities funds. Also missing from the list is an intermediate-term U.S. Treasury bond fund. (Of course account holders can purchase the usual ETFs that our models rely on for these asset classes, incurring the standard Vanguard brokerage commission).

The Vanguard Group has staked its reputation on low-cost passive investing. It created the first index fund, and has a solid lineup of 64 stock and bond ETFs, all of which can be traded commission-free by Vanguard brokerage account holders. While the company has announced plans to expand into alternative asset classes (alternative beta), it does not offer commission-free trades in gold or commodities funds. Also missing from the list is an intermediate-term U.S. Treasury bond fund. (Of course account holders can purchase the usual ETFs that our models rely on for these asset classes, incurring the standard Vanguard brokerage commission).

The table below lists the ETFs we use in our model portfolios, and the zero-commission ETF that Vanguard account holders can substitute for each. We identify these funds by systematically measuring the correlation of the daily returns of each commission-free ETF offered by Vanguard, and comparing that to our usual set of 9 ETFs. Scroll down or click any ETF symbol in the Vanguard column to see the detailed analysis for that fund.

| Asset Class |

Usual ETF Symbol |

Vanguard Commission Free Alternative |

|---|---|---|

| U.S. Stocks | SPY | VTI, VOO |

| Medium-Term U.S. Bonds | IEF | - |

| Long-Term U.S. Bonds | TLT | VGLT ? |

| European Stocks | IEV | VGK |

| Emerging Markets Stocks | EEM | VWO |

| U.S. Real Estate (REITs) | ICF | VNQ |

| International Real Estate | RWX | VNQI |

| Commodities | DBC | - |

| Gold | GLD | - |

U.S. Stocks: use Vanguard Total Stock Market ETF (VTI) or Vanguard S&P 500 ETF (VOO)

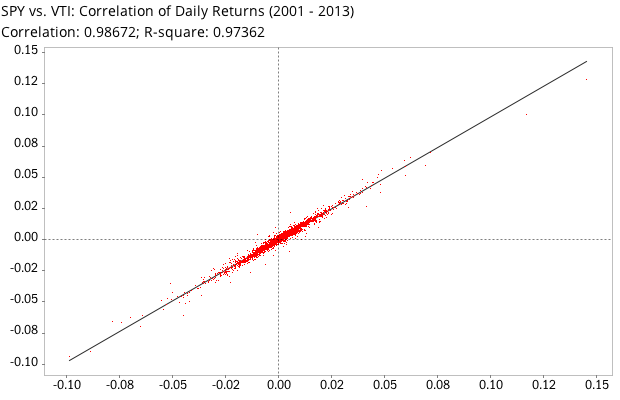

In our model portfolios, we use the SPDR S&P 500 Index Fund (SPY) to track U.S. stocks. Vanguard account holders have two commission-free options to invest in this asset class: Vanguard S&P 500 ETF (VOO) or Vanguard Total Stock Market (VTI). VTI should appeal to investors who prefer a broader index. While VOO (and our usual fund, SPY) tracks the 500 largest U.S. stocks, VTI tracks the MSCI U.S. Broad Market Index, which represents over 99% of the total market capitalization of all U.S. common stocks. VTI has an annual expense ratio of 0.05%, which is lower than SPY (0.09%). It is a highly regarded fund that currently has 29.3 billion dollars under management, and trades an average of 1.9 million shares per day. As shown in the chart below, VTI has a 0.987 correlation to the SPY, which is very high (1.0 indicates a perfect proxy). Based on the large amount of data included in our comparison — 12 years of daily returns — we expect the VTI and SPY to continue to be interchangeable in the future.

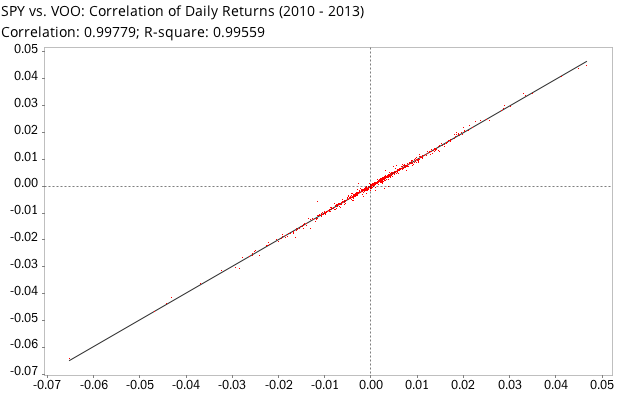

Because the second option for Vanguard account holders — Vanguard S&P 500 ETF (VOO) — tracks the same index as the fund we use in our model portfolios (SPY), you’d expect their correlation to be very high, and the data confirms this: 0.998 (1.0 indicates a perfect proxy). For all practical purposes, VOO and SPY are interchangeable:

Medium-Term U.S. Bonds

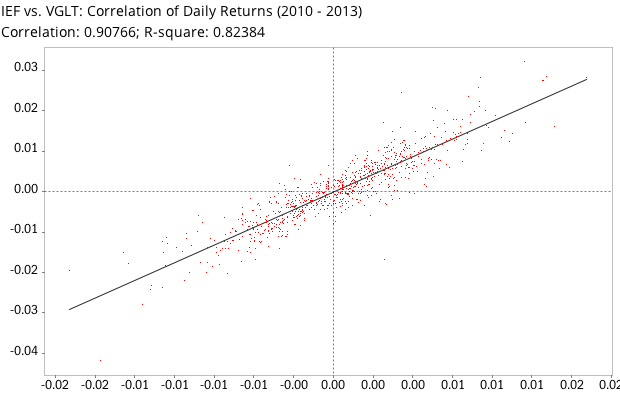

It’s curious that a company like Vanguard does not offer an intermediate U.S. Treasury ETF. We use iShares Barclays 7-10 Year Treasury Bond (IEF) to track this asset class in our model portfolios. The Vanguard ETF with the closest correlation to IEF is Vanguard Long-Term Government Bond Index (VGLT). But this is a different beast, and the correlation coefficient is only 0.908, as shown in the chart below. To follow our model portfolios, it would be a better option to just use the IEF instead.

Long-Term U.S. Bonds: consider Vanguard Long-Term Government Bond Index (VGLT)

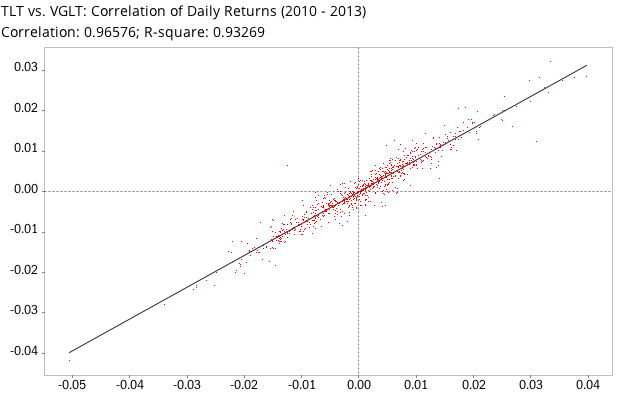

We use iShares Barclays 20+ Year Treasury Bond (TLT) to track long-term U.S. bonds. The Vanguard fund that most closely correlates to TLT is Vanguard Long-Term Government Bond Index (VGLT), but it’s not a perfect match. VGLT tracks the Barclays U.S. Long Government Float Adjusted Index — bonds with maturities greater than 10 years. This is somewhat different from TLT, which tracks the Barclays U.S. 20+ Year Treasury Bond Index. TLT is more volatile, which will usually yield better returns when used in our tactical strategies. Nonetheless, the correlation between VGLT and TLT is high, at 0.966:

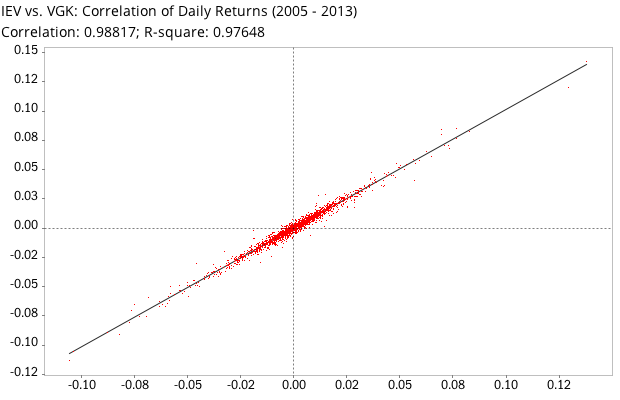

European Stocks: use Vanguard FTSE Europe ETF (VGK)

For exposure to European equities, our model portfolios use the iShares S&P Europe 350 ETF (IEV). Vanguard allows free trading in its industry-standard European equities fund: the Vanguard FTSE Europe ETF (VGK), which has a very high (0.988) correlation to IEV, making it a great substitute. VGK has over $5.7 billion under management, trades on average 2.1 million shares a day, and has an expense ratio of 0.12 percent (compare this to 0.60% for IEV). The fund tracks the FTSE Developed Europe Index which contains about 500 European stocks, more than the 350 tracked by the IEV fund.

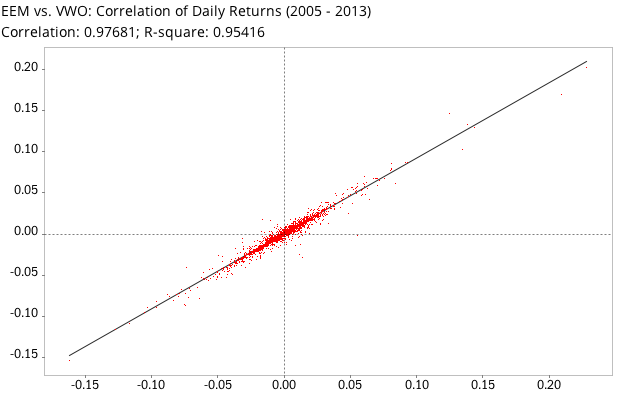

Emerging Markets Stocks: use Vanguard FTSE Emerging Markets ETF (VWO)

Our model portfolios use EEM (iShares MSCI Emerging Markets Index) for exposure to emerging markets equities. Vanguard offers its highly correlated (r=0.977) zero-commission alternative: the Vanguard FTSE Emerging Markets ETF (VWO). This fund has an average daily trading volume of 19.8 million shares, a total of $56 billion under management, and an annual expense ratio of 0.18 percent (which is very low for emerging markets ETFs — compare to 0.69% for EEM). It tracks the FTSE Emerging Index. VWO is an excellent alternative to EEM.

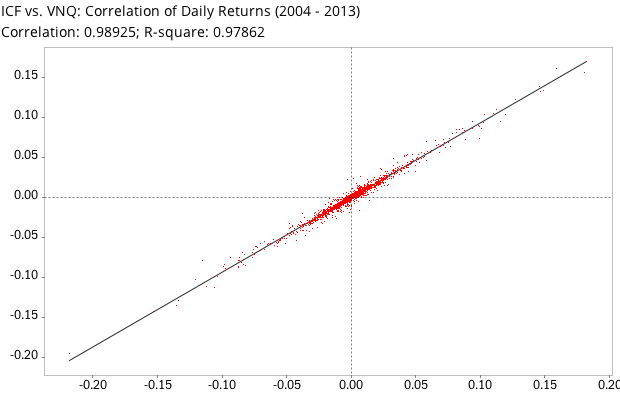

U.S. Real Estate (REITs): use Vanguard REIT Index ETF (VNQ)

There are a number of good U.S. REIT funds on the market. In our model portfolios we use iShares Cohen & Steers Realty Majors (ICF). If you're a Vanguard customer, take a look at the zero-commission Vanguard REIT Index ETF (VNQ). With a correlation coefficient of 0.989 against ICF, its returns are going to be practically identical. VNQ tracks the MSCI U.S. REIT Index, has $19.34 billion under management, trades 2.4 million shares per day, and will cost you only 0.10 percent per year in management fees. What's not to like?

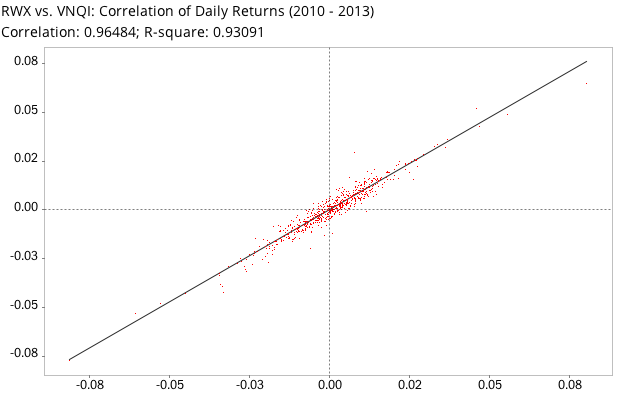

International Real Estate (REITs): use Vanguard Global ex-U.S. Real Estate ETF (VNQI)

Our model portfolio choice to track international real estate is SPDR Dow Jones International Real Estate (RWX). Vanguard's commission-free offering for this asset class is its Global ex-U.S. Real Estate ETF (VNQI), which tracks the S&P Global ex-U.S. Property Index. It's a relatively new fund, with $810 million in assets, an annual expense ratio of 0.32 percent, and not actively traded (average of 70,600 shares per day). With a correlation coefficient of 0.965 against RWX, its returns are going to be reasonably similar:

Comments

To add a comment, please Sign In.