Fidelity Investments offers 65 commission-free iShares funds that track most common asset classes. Many of these are widely held, industry-leading funds. Four of the ETFs used in our Adaptive Portfolios are on Fidelity's zero-commission list: iShares Barclays 7-10 Year Treasury Bond (IEF), iShares Barclays 20+ Year Treasury Bond (TLT), iShares S&P Europe 350 Index (IEV), and iShares MSCI Emerging Markets Index (EEM).[1] Good substitutes are available to track U.S. stocks and real estate. Missing from the Fidelity commission-free lineup are funds to track international real estate, commodities, and gold. (For these, you can of course purchase the usual ETFs used by our model portfolios, incurring the standard Fidelity trading commission).

Fidelity Investments offers 65 commission-free iShares funds that track most common asset classes. Many of these are widely held, industry-leading funds. Four of the ETFs used in our Adaptive Portfolios are on Fidelity's zero-commission list: iShares Barclays 7-10 Year Treasury Bond (IEF), iShares Barclays 20+ Year Treasury Bond (TLT), iShares S&P Europe 350 Index (IEV), and iShares MSCI Emerging Markets Index (EEM).[1] Good substitutes are available to track U.S. stocks and real estate. Missing from the Fidelity commission-free lineup are funds to track international real estate, commodities, and gold. (For these, you can of course purchase the usual ETFs used by our model portfolios, incurring the standard Fidelity trading commission).

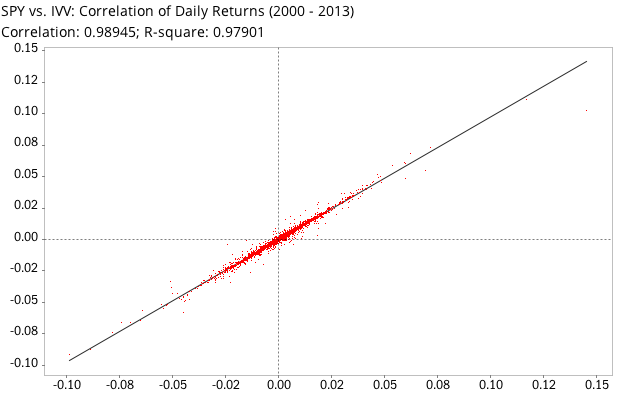

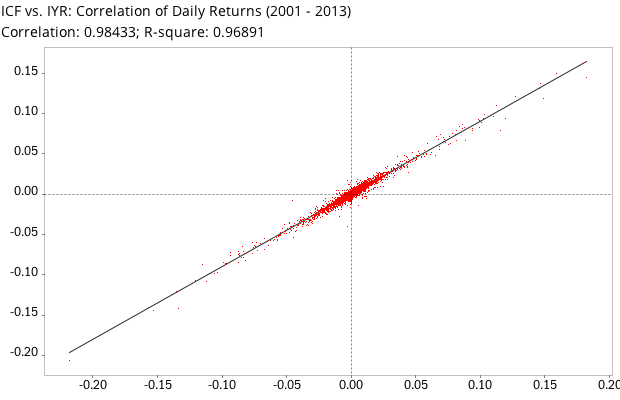

The table below lists the ETFs we use in our model portfolios, and the best zero-commission ETF that Fidelity account holders can substitute for each. We identify these funds by systematically measuring the correlation of the daily returns of each commission-free ETF offered by Fidelity, and comparing that to our usual set of 9 ETFs. Scroll down or click any ETF symbol in the Fidelity column to see the detailed analysis for that fund.

| Asset Class |

Usual ETF Symbol |

Fidelity Commission Free Alternative |

|---|---|---|

| U.S. Stocks | SPY | IVV |

| Medium-Term U.S. Bonds | IEF | IEF |

| Long-Term U.S. Bonds | TLT | TLT |

| European Stocks | IEV | IEV |

| Emerging Markets Stocks | EEM | EEM[1] |

| U.S. Real Estate (REITs) | ICF | IYR |

| International Real Estate | RWX | - |

| Commodities | DBC | - |

| Gold | GLD | - |

U.S. Stocks: use iShares Core S&P 500 ETF (IVV)

In our model portfolios, we use the SPDR S&P 500 Index Fund (SPY) to track U.S. stocks. Fidelity offers a commission-free ETF to invest in this asset class: iShares Core S&P 500 ETF (IVV). Since both funds track the same underlying index (the S&P 500), you'd expect their correlation to be high, and it is: 0.989 (1.0 indicates a perfect proxy). For all practical purposes, IVV and SPY are interchangeable.

IVV has an annual expense ratio of 0.07%, which is lower than SPY (0.09%). It is a widely held fund that currently has 40.9 billion dollars under management, and trades an average of 3.8 million shares per day.

U.S. Real Estate (REITs): use iShares Dow Jones U.S. Real Estate (IYR)

There are a number of good U.S. REIT funds on the market. In our model portfolios we use iShares Cohen & Steers Realty Majors (ICF). If you're a Fidelity customer, you can use the zero-commission iShares Dow Jones U.S. Real Estate (IYR). With a correlation coefficient of 0.984 against ICF, its returns are going to be practically identical. IYR tracks the Dow Jones U.S. Real Estate Index, has 5.76 billion dollars under management, trades 7.9 million shares per day, and will cost you 0.47 percent per year in management fees.

Notes

- As of 30 April 2013, Fidelity will change its free ETF lineup. The EEM fund will no longer be offered, but two other funds will replace it: iShares MSCI Emerging Markets EMEA (EEME) and iShares Core MSCI Emerging Markets (IEMG). These are new funds, with not enough history to draw any definitive conclusions about their correlation to other emerging markets funds and indexes. However, the second fund (IEMG) should prove to be a good proxy, based on the choice of underlying index.

Comments

To add a comment, please Sign In.