TD Ameritrade account holders enjoy commission-free trading in over 100 ETFs, including a number of low-cost Vanguard funds, and many other popular ETFs. Three of the ETFs used in our Adaptive Portfolios are on Ameritrade's zero-commission list: iShares Barclays 20+ Year Treasury Bond (TLT) for exposure to long-term bonds, SPDR Dow Jones International Real Estate (RWX) and even the PowerShares DB Commodity Index Tracking Fund (DBC). Great substitutes — Vanguard funds — are available for 3 other asset classes: U.S. real estate, European and emerging market stocks. But Ameritrade does not provide a commission-free alternative for medium-term U.S. bonds or gold.

TD Ameritrade account holders enjoy commission-free trading in over 100 ETFs, including a number of low-cost Vanguard funds, and many other popular ETFs. Three of the ETFs used in our Adaptive Portfolios are on Ameritrade's zero-commission list: iShares Barclays 20+ Year Treasury Bond (TLT) for exposure to long-term bonds, SPDR Dow Jones International Real Estate (RWX) and even the PowerShares DB Commodity Index Tracking Fund (DBC). Great substitutes — Vanguard funds — are available for 3 other asset classes: U.S. real estate, European and emerging market stocks. But Ameritrade does not provide a commission-free alternative for medium-term U.S. bonds or gold.

The table below lists the ETFs we use in our model portfolios, and the zero-commission ETF that Ameritrade account holders can substitute for each. We identify these funds by systematically measuring the correlation of the daily returns of each commission-free ETF offered by Ameritrade, and comparing that to our usual set of 9 ETFs. Scroll down or click any ETF symbol in the Ameritrade column to see the detailed analysis for that fund.

| Asset Class |

Usual ETF Symbol |

Ameritrade Commission Free Alternative |

|---|---|---|

| U.S. Stocks | SPY | VTI |

| Medium-Term U.S. Bonds | IEF | - |

| Long-Term U.S. Bonds | TLT | TLT |

| European Stocks | IEV | VGK |

| Emerging Markets Stocks | EEM | VWO |

| U.S. Real Estate (REITs) | ICF | VNQ |

| International Real Estate | RWX | RWX |

| Commodities | DBC | DBC |

| Gold | GLD | - |

U.S. Stocks: use Vanguard Total Stock Market ETF (VTI)

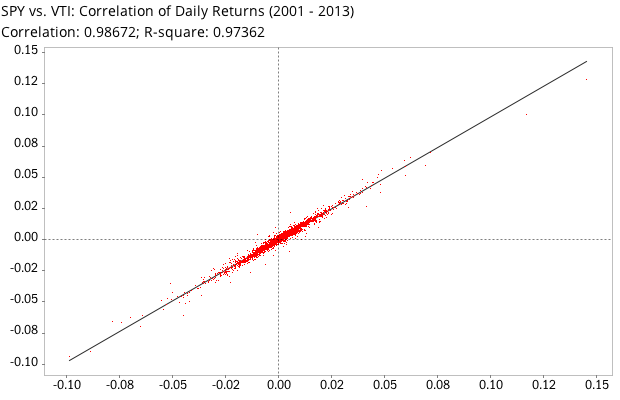

In our model portfolios, we use the SPDR S&P 500 Index Fund (SPY) to track U.S. stocks. Ameritrade offers a great commission-free ETF to invest in this asset class: Vanguard Total Stock Market (VTI). VTI should appeal to investors who prefer a broader index. While SPY tracks the 500 largest U.S. stocks, VTI tracks the MSCI U.S. Broad Market Index, which represents over 99% of the total market capitalization of all U.S. common stocks. As shown in the chart below, VTI has a 0.987 correlation to the SPY, which is very high (1.0 indicates a perfect proxy). Based on the large amount of data included in our comparison — 12 years of daily returns — we expect the VTI and SPY to continue to be interchangeable in the future.

VTI has an annual expense ratio of 0.05%, which is lower than SPY (0.09%). It is a highly regarded fund that currently has 29.3 billion dollars under management, and trades an average of 1.9 million shares per day.

European Stocks: use Vanguard FTSE Europe ETF (VGK)

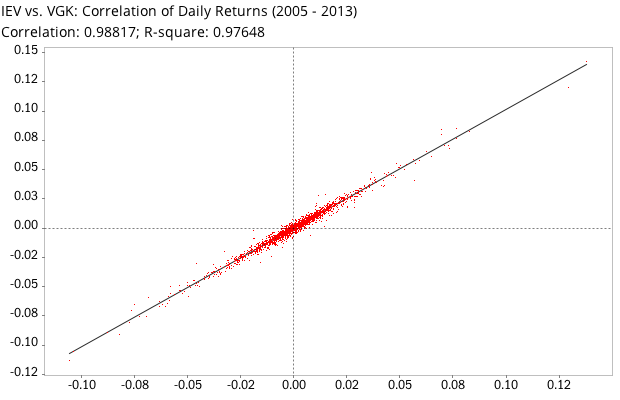

For exposure to European equities, our model portfolios use the iShares S&P Europe 350 ETF (IEV). Ameritrade allows free trading in the industry-standard European equities fund: the Vanguard FTSE Europe ETF (VGK), which has a very high (0.988) correlation to IEV, making it a great substitute. VGK has over $5.7 billion under management, trades on average 2.1 million shares a day, and has an expense ratio of 0.12 percent (compare this to 0.60% for IEV). The fund tracks the FTSE Developed Europe Index which contains about 500 European stocks, more than the 350 tracked by the IEV fund.

Emerging Markets Stocks: use Vanguard FTSE Emerging Markets ETF (VWO)

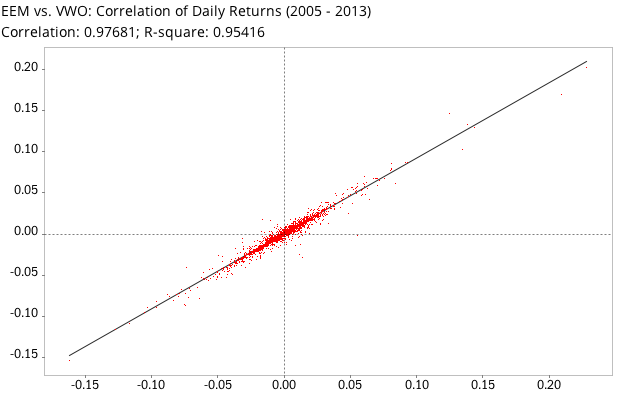

Our model portfolios use EEM (iShares MSCI Emerging Markets Index) for exposure to emerging markets equities. Ameritrade offers a highly correlated (r=0.977) zero-commission alternative: Vanguard FTSE Emerging Markets ETF (VWO). This fund has an average daily trading volume of 19.8 million shares, a total of $56 billion under management, and an annual expense ratio of 0.18 percent (which is very low for emerging markets ETFs — compare to 0.69% for EEM). It tracks the FTSE Emerging Index. VWO is an excellent alternative to EEM.

U.S. Real Estate (REITs): use Vanguard REIT Index ETF (VNQ)

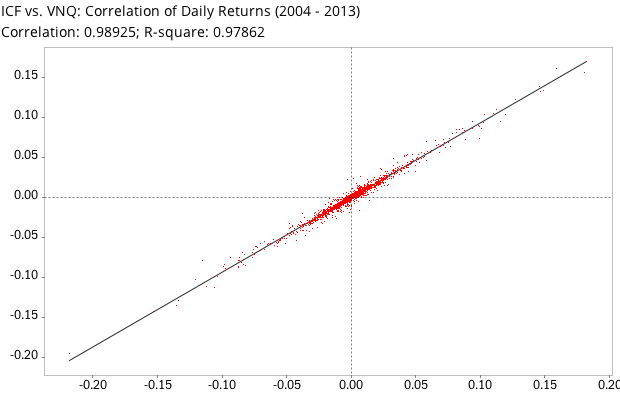

There are a number of good U.S. REIT funds on the market. In our model portfolios we use iShares Cohen & Steers Realty Majors (ICF). If you're a Ameritrade customer, take a look at the zero-commission Vanguard REIT Index ETF (VNQ). With a correlation coefficient of 0.989 against ICF, its returns are going to be practically identical. VNQ tracks the MSCI U.S. REIT Index, has $19.34 billion under management, trades 2.4 million shares per day, and will cost you only 0.10 percent per year in management fees. What's not to like?

Comments

To add a comment, please Sign In.